How to Read

The COT Reports

Simplified

Understand the Commitments of Traders Reports step by step with our comprehensive PDF guide.

A Complete Guide for Retail Traders

The Commitments of Traders (COT) Reports are a valuable tool for traders and investors to understand market sentiment and positioning. The CFTC releases reports detailing the open interest and trading activity of different market participants, including commercial traders and non-commercial traders such as hedge funds and large speculators.

As a result, retail traders like you and me can use this information – in conjunction with Technical Analysis (TA) – to make more informed trading decisions.

Interpreting the data can be a complex task, especially for beginners. That’s why I have created this PDF guide that will teach you how to read the COT Reports with ease. This guide is perfect for traders who are new to the market or looking to expand their knowledge of market analysis.

Learn how to read the COT Reports with the simplified PDF guide! Perfect for beginners looking to learn how to analyze and how to use the COT data.

“This PDF guide is divided into three parts:

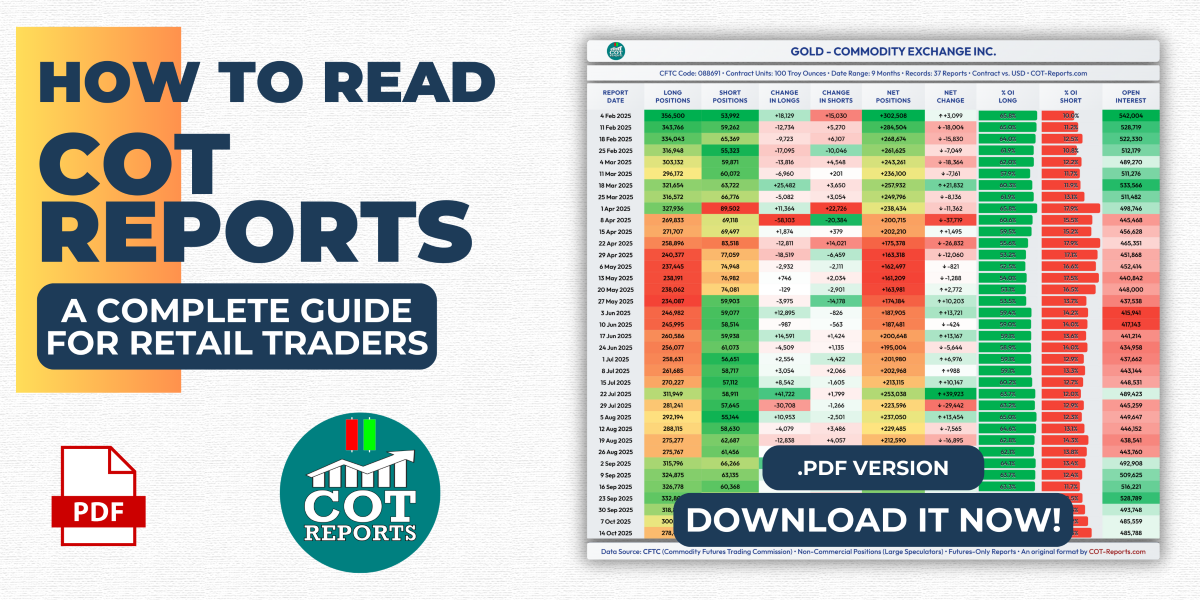

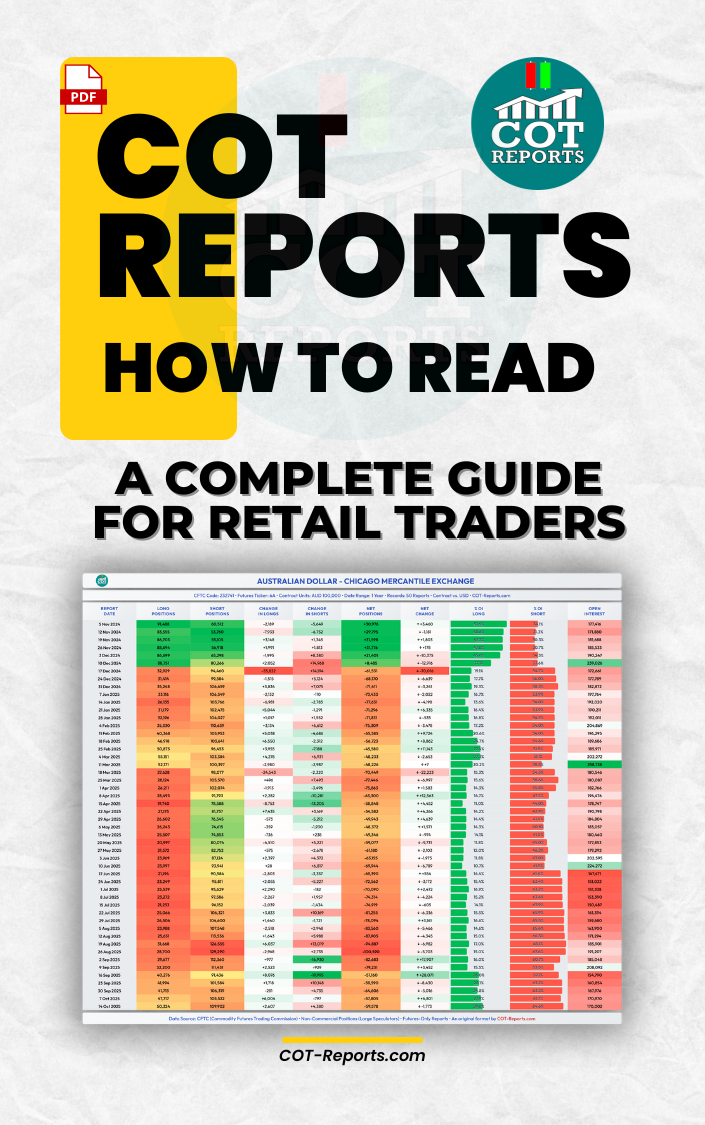

Firstly, I cover the basics of COT reports by explaining where the data comes from, how it is provided, and what it is used for. Additionally, I also provide an in-depth explanation of the different columns in the COT reports and how to interpret them.

Secondly, I dive deeper into the COT reports by introducing my custom version of the COT reports, and furthermore, how to use the colors in them to gain more insight.

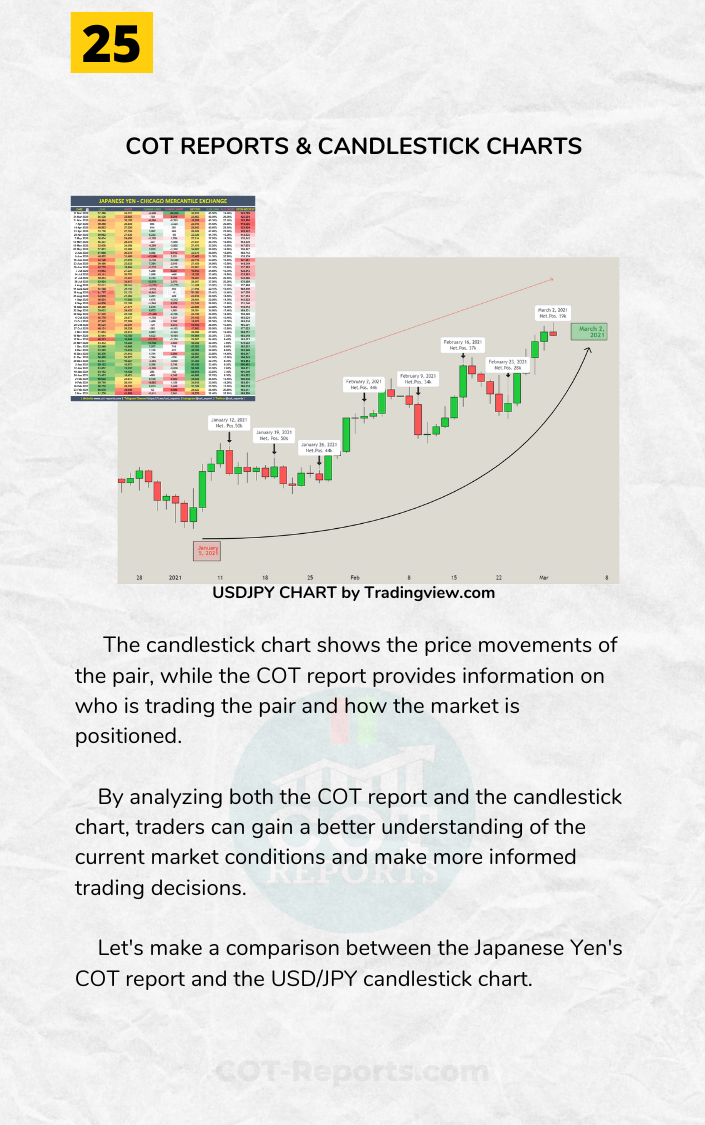

Lastly, I show you how to analyze the relationship between a currency’s COT report and candlestick chart, in order to give you a complete picture of market sentiment and positioning.

Additionally, you will learn practical strategies for incorporating COT data into your trading decisions, including timing entries and exits based on institutional positioning changes.

Ready to master COT Reports analysis? Get instant access to the complete PDF guide now.

Download PDF Guide NowPreview of the PDF Guide “How to Read the COT Reports”

Alternative download option for those who prefer BuyMeACoffee

Discover the Market Insights of Smart Money

These reports are a valuable tool for understanding market sentiment and positioning. Additionally, you can use the COT Reports to identify potential trend reversals.

“ Market AnalystAdvantages of Using the Commitments of Traders COT Reports

Understanding Market Positioning

For example, if hedge funds have a large net short position in a particular market, this may indicate that they are positioning themselves for a market downturn.

Identifying Potential Trend Reversals

You can use the COT reports to identify potential trend reversals. For example, when non-commercial traders have a large net short position, it may indicate that the market is oversold and due for a rebound.

Complementary to Technical Analysis (TA)

The COT reports can be used in conjunction with Technical Analysis (TA) to get a better view of the market. Additionally, it can help technical traders to identify the large market player’s position and make better trading decisions.

Available for Free

I am sharing the COT reports for free. As a result, traders and investors can access this valuable information without having to pay for it.

Overall, traders find the COT reports to be a valuable tool. They use the COT reports to gain insight into market sentiment, positioning, and potential trend reversals. Additionally, traders often use the reports in conjunction with other market analysis techniques, such as Technical Analysis, to make more informed decisions.

Start Your COT Reports Journey Today

Download the complete PDF guide and learn how to read and interpret the Commitments of Traders Reports like a professional.